PortfolioMetrics vs. Nitrogen

The Best Choice for Professional Investment Reports?

Financial advisors are increasingly moving away from high-cost enterprise platforms in favor of agile, data-driven diagnostic tools. While Nitrogen (formerly Riskalyze) has long been the go-to platform for risk-centric sales proposals, PortfolioMetrics has emerged as a great alternative for advisors who need deep quantitative analysis and professional PDF reporting at a fraction of the cost.

This comparison breaks down why many advisors are switching to PortfolioMetrics for their client review and reporting needs.

| PortfolioMetrics | Nitrogen | |

|---|---|---|

| Core Focus | Quantitative Backtesting & Optimization | Risk Alignment & Sales Enablement |

| Primary Pricing | $46.90 / month (Professional) | $250 - $450+ / month (Standard/Elite) |

| Commitment | Monthly (Cancel Anytime) | Usually 12-Month Contract |

| Metrics Measurement | Industry-standard quantitative metrics | Proprietary, branded risk frameworks |

| Metrics Used | Volatility, Drawdown, VaR, CAGR, Sharpe, Sortino, etc. | Risk Number®, 95% Historical Range™, GPA® |

| Portfolio Optimization | Industry-standard methods like Mean–variance, Risk Parity, constrained and objective-based approaches | Focuses on aligning portfolios to a target risk level |

| PDF Reporting | Full Technical Analysis + Customisable | Reports Builder (IPS, Snapshot, Stats) |

| Best Fit For | Investors and advisors seeking transparent, quantitative portfolio analysis and strategy evaluation | Advisors prioritizing standardized risk communication and client alignment |

1. Client Reporting: Narrative vs. Deep Analysis

Nitrogen: The "Sales" Story

Nitrogen’s PDF reports are built around the Risk Number® and the 95% Historical Range™. The goal is to simplify the conversation to a single number between 1 and 99. While excellent for "visual storytelling" and client acquisition, some advisors find the reports lack the statistical depth required for sophisticated clients or institutional-level reviews.

PortfolioMetrics: The "Quantitative" Analysis

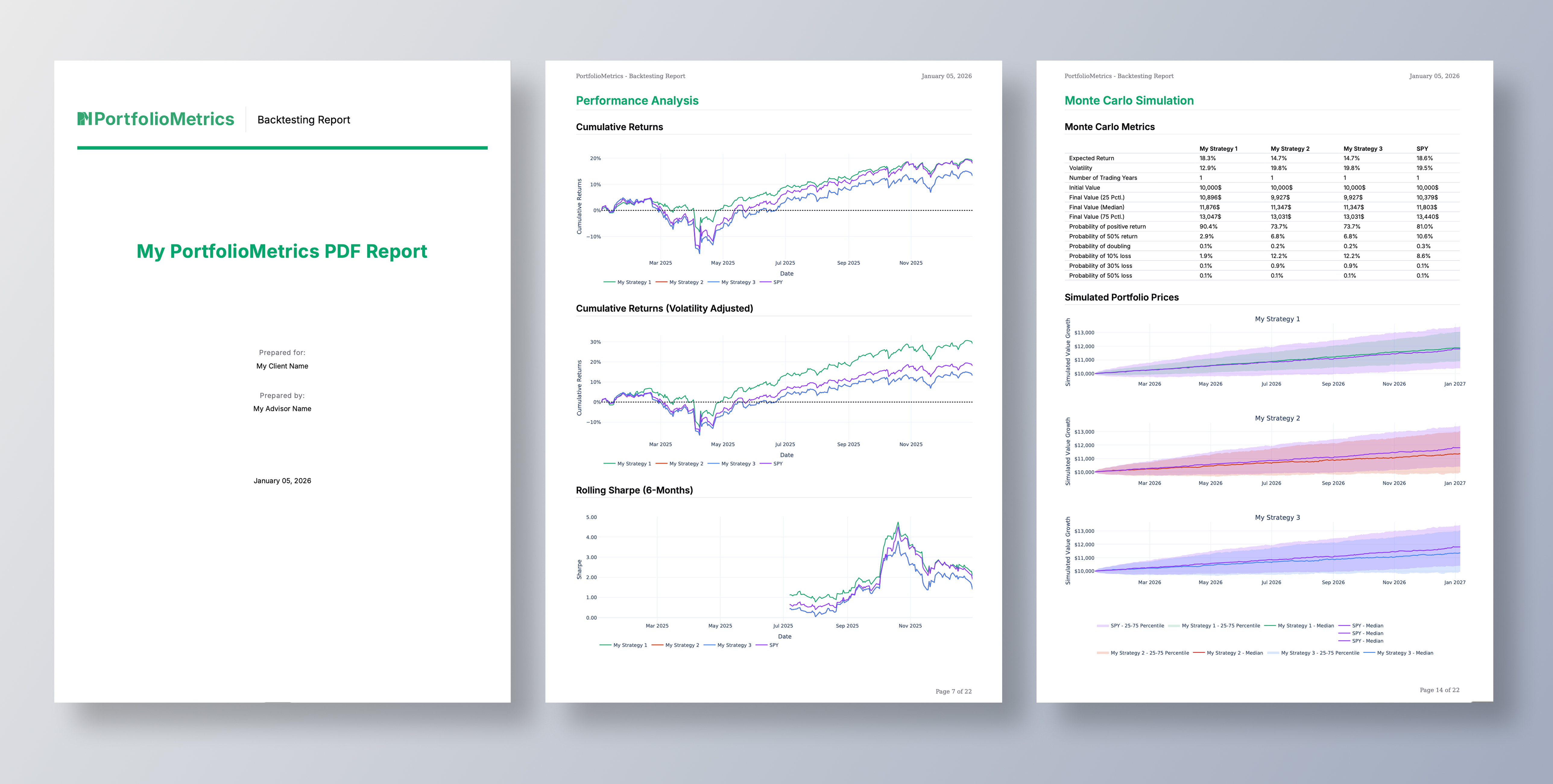

PortfolioMetrics provides high-resolution PDF reports that focus on Strategy Validation. Our reports include:

- 40+ Years of Backtesting: Show how a strategy performed through the '87 crash, the Dot-com bubble, and 2008 housing market crash.

- Monte Carlo Simulations: Forecast price developments over 50 years to stress-test long-term goals.

- Risk-Adjusted Metrics: Professional-grade statistics like the Serenity Ratio, UPI, Sortino Ratio, and Recovery Factor to prove the quality of your management.

- Efficient Frontier Mapping: Visually demonstrate to clients that their portfolio is optimized for the highest possible return at their given risk level.

2. Branding and Customization

Both platforms recognize that a report should reflect your firm, not the software provider's.

- Nitrogen Branding: Custom colors and logos are available, but typically require the higher-tier Ignite or Ultimate plans.

- PortfolioMetrics Branding: Professional PDF reporting with your custom title, your client name and your own name.

3. The Cost Gap

The most significant difference between the two platforms is the economic model. Nitrogen is an enterprise SaaS product designed for large firms with high overhead. PortfolioMetrics is a diagnostic utility designed for efficiency.

- Nitrogen Branding: A solo advisor can expect to pay approximately $3,000 to $5,400 per year for a full suite of reporting and research tools.

- PortfolioMetrics Advantage: For just $469 per year (Professional tier), you get high-quality PDF reports, deeper historical data, and more advanced optimization tools.

Advisors switching from Nitrogen to PortfolioMetrics typically save over 80% on their annual reporting software spend while increasing the technical rigor of their client deliverables.

4. Why Advisors are Switching

Key Switch Factors:

- No Contract Traps: Nitrogen often requires annual commitments that are difficult to exit. PortfolioMetrics offers total flexibility with monthly billing.

- Broader Asset Coverage: PortfolioMetrics includes high-quality data for US, EU, Latin American, and Asian markets, including UCITS ETFs, which is often a limitation in US-centric tools.

- Statistical Usefulness: Many advisors feel Nitrogen's Risk Number is a "sales tool" rather than a scientific measurement. PortfolioMetrics uses established, transparent methodologies like the Markowitz mean-variance model.

Conclusion: Which is right for you?

Choose Nitrogen if: You are a high-volume sales firm that needs a heavy focus on lead generation, CRM integrations, and a simplified "Risk Number" to close prospects quickly.

Choose PortfolioMetrics if: You are a professional advisor or analyst who values transparency, deep historical backtesting, and quantitative accuracy - and you want to provide professional, branded PDF reports without the enterprise price tag.