We’ve been listening to your feedback and made some changes to help you manage your portfolio more effectively. Today, we’re excited to introduce three updates. Our biggest update is the new Portfolio Optimization Tool, designed to offer insights and detailed metrics for optimizing your strategy. The other two - CSV Import/Export and Cash as an Asset Class - are smaller, yet important enhancements to streamline your workflow and simplify your portfolio management. Prefer to watch instead? Here are both use cases explained in video format:

Update 1: Portfolio Optimization Tool

Our most significant update is the new Portfolio Optimization Tool. With this tool, you can take your investment planning a step further. Unlike our portfolio backtesting tool - which only gives you a basic look at the efficient frontier - this Optimizatio Tool goes deeper. It’s not just about managing your portfolio; It’s all about giving you more insights into fine-tuning your strategy.

What it Offers:

- Pre-Set Constraints & Objectives: You can define detailed rules for your strategy by setting asset-level or group-level constraints - such as minimum and maximum allocations - and by specifying target return or volatility. This means you can fine-tune your portfolio optimization to match your exact requirements.

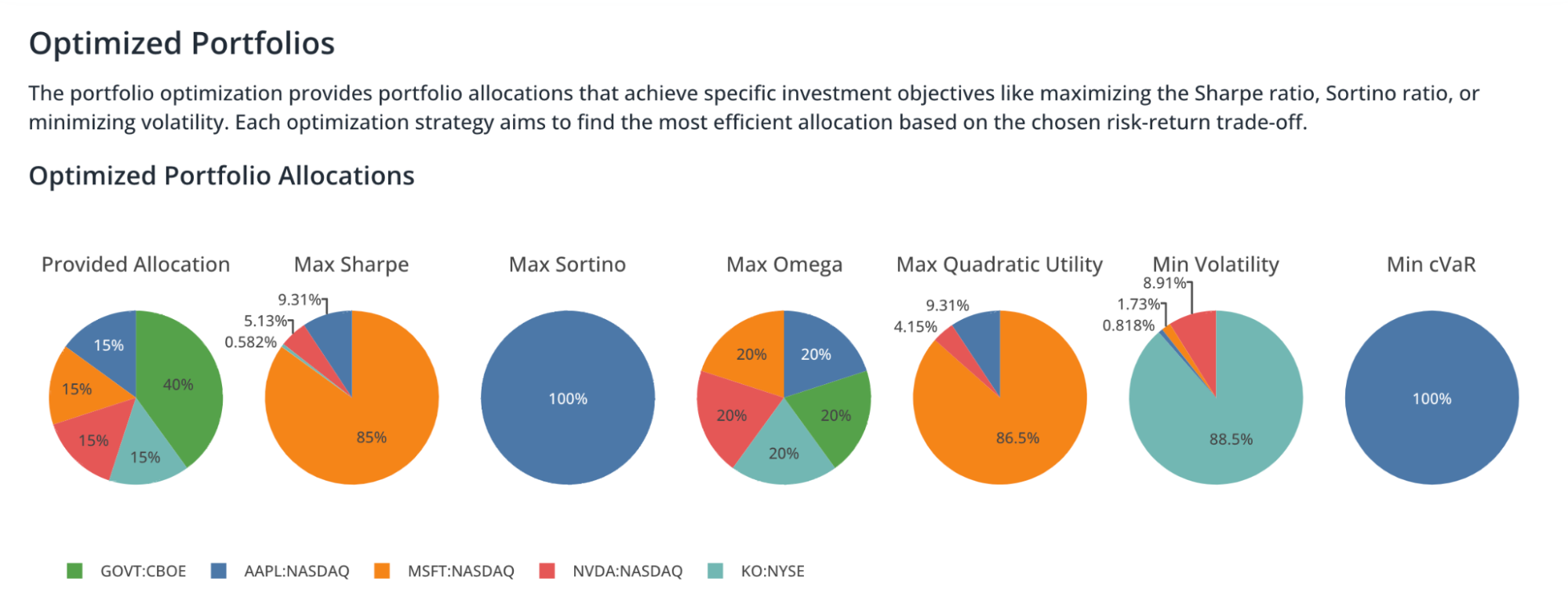

- Optimized Portfolios: The tool presents 6 optimized portfolios, each designed to meet a specific objective - maximizing the Sharpe ratio, Sortino ratio, Omega, or Quadratic Utility, and minimizing volatility or cVaR. With these options, you can test your strategy against defined investment targets and see how different allocations perform.

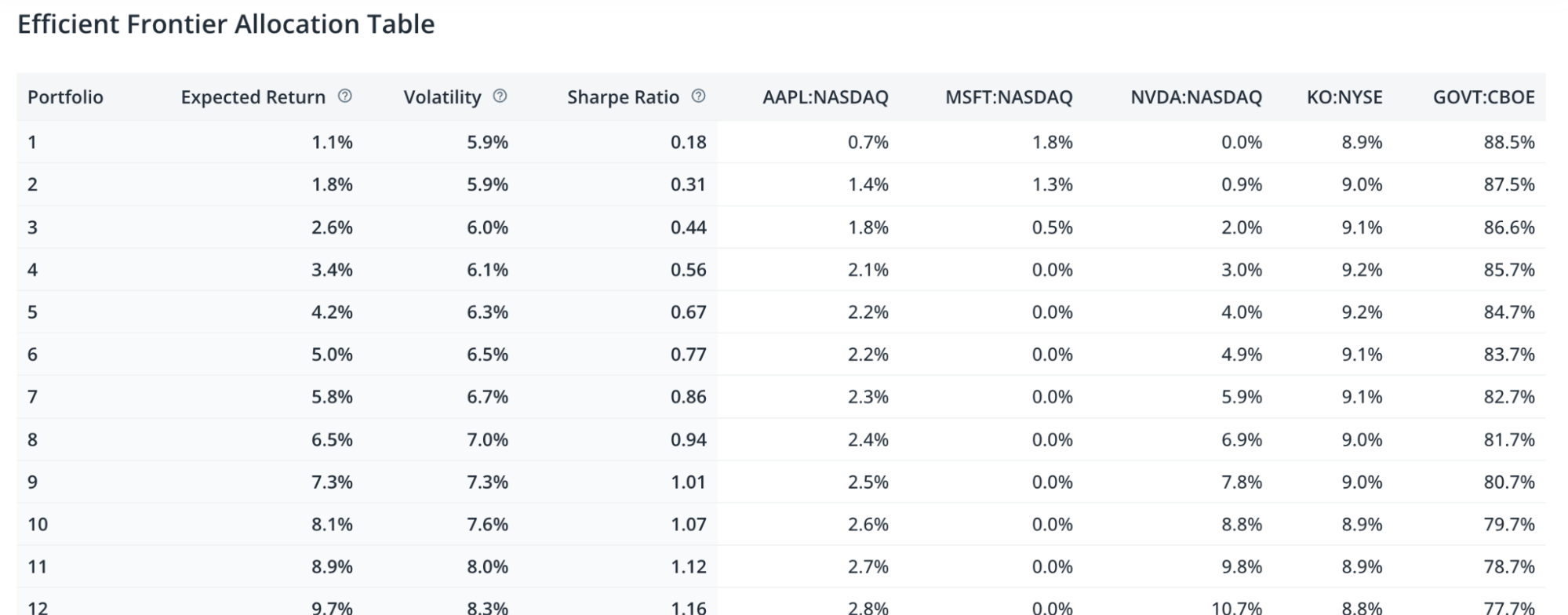

- Efficient Frontier: You see the efficient frontier built on Harry Markowitz’s Mean-Variance Model, which presents 100 different portfolio allocations. This comprehensive view lets you explore how various risk-return scenarios play out, giving you a broad perspective on different portfolio options.

This extra level of insight gives you a better view of your portfolio, so you can fine-tune your strategy on a more insightful basis as you plan your next investment strategy.

Update 2: Cash as an Asset Class

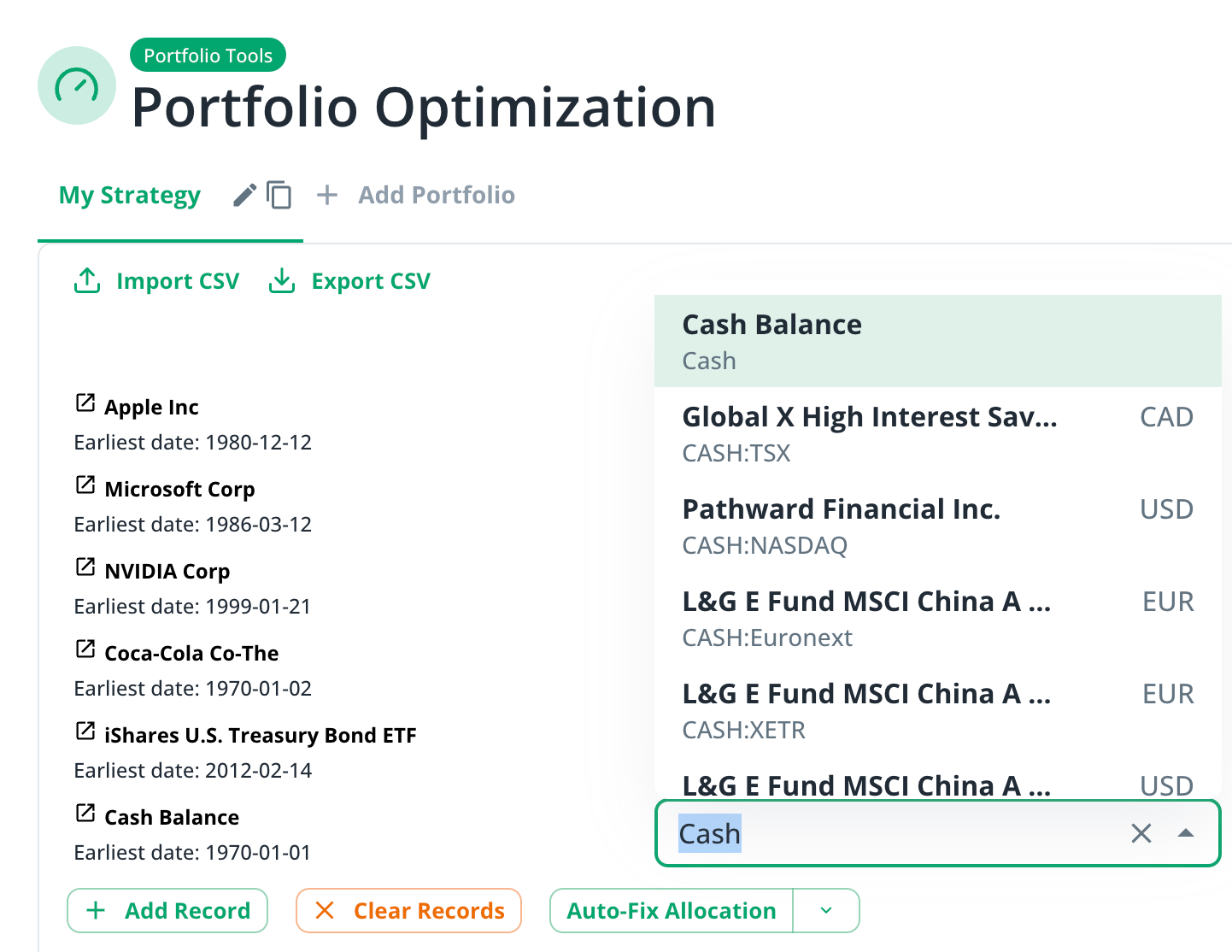

We recognize that cash plays an important role in many investment strategies. With this update, adding cash to your portfolio is now straightforward.

How to Add Cash:

Just type “Cash” in the symbol column, select the Cash Balance option, and assign the allocation you prefer. This simple addition makes it easier to represent cash accurately in your portfolio.

Update 3: CSV Import/Export

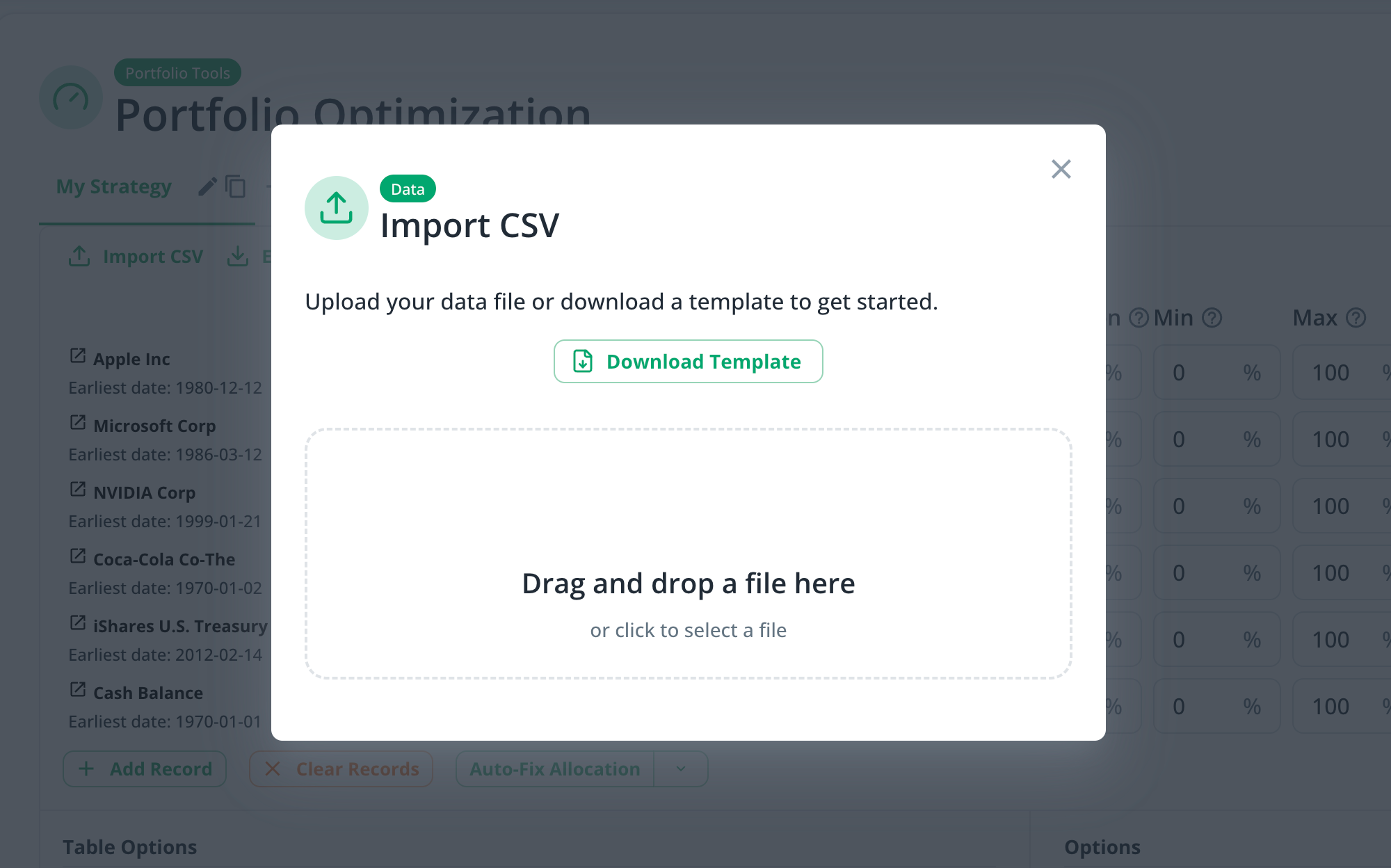

Managing a large portfolio shouldn’t be a hassle. That’s why we’ve added CSV import and export features to streamline your workflow.

Where to Find It:

Look for these options at the top left under My Strategy.

How It Works:

Your CSV file should include at least two columns: symbol and allocation. If you’re not sure about the format, you can download our template to help guide you. For more advanced setups, you can also include additional columns like Min Allocation, Max Allocation, Expected Return, Volatility, and Group. This lets you incorporate more detailed rules into your strategy.

Note: The Min Allocation, Max Allocation, and Group columns are only supported in the Optimization Tool, not in the Backtesting tool.

Help Us Improve

We truly appreciate your feedback, which has been essential in guiding these updates. To help us keep improving, please take a moment to complete our quick survey - it’s just 3 fast questions designed to capture your thoughts and ideas. Take the Survey.