Exchange-traded funds (ETFs) have gained popularity as investment vehicles, providing diversified exposure to various markets and sectors globally. Two prominent ETFs for investors seeking broad global exposure are the Vanguard Total World Stock ETF (VT) and the Vanguard FTSE All-World UCITS ETF (VWCE). Both ETFs aim to give investors exposure to a wide array of global equities, but there are notable differences that investors should be aware of before making an investment decision. The most important difference concerns the geographic availability.

Comparing VT and VWCE: Key Differences to Consider

The VT ETF was launched in 2008 and is listed on the New York Stock Exchange (NYSE). The VWCE, on the other hand, was introduced in 2019 and is listed on several European exchanges. Both ETFs aim to track the performance of global stock markets, but they follow different indexes and are structured differently.

- Comparing VT and VWCE: Key Differences to Consider

VT is primarily available to investors in the United States, while VWCE is more accessible to European investors due to its UCITS (Undertakings for the Collective Investment in Transferable Securities) status, which makes it compliant with European regulatory standards. As a matter of fact, European Investors cannot buy non-UCITS without overcoming some hurdles. - Expense Ratio: How Do VT and VWCE Compare in Costs?

The VT has an expense ratio of 0.07%, while the VWCE has a slightly higher expense ratio of 0.22%. The expense ratio is the annual fee that funds charge their shareholders to cover the fund's operating expenses, expressed as a percentage of the fund's average net assets. This difference in expense ratios can impact long-term returns, especially for large investment portfolios. - Index Tracked: What Indexes Do VT and VWCE Follow?

VT tracks the FTSE Global All Cap Index, which includes both developed and emerging markets across all market capitalizations. VWCE tracks the FTSE All-World Index, which also covers developed and emerging markets but includes only large- and mid-cap stocks. - Dividend Treatment: How Do VT and VWCE Handle Dividends?

VT pays dividends quarterly, while VWCE is accumulating and pays no dividends but reinvests the earnings directly. - Number of Holdings: How Diversified Are VT and VWCE?

VT comprises around 10,000 holdings, providing broad diversification across various sectors and geographies. In contrast, VWCE holds approximately 3,500 stocks, offering a more focused but still diversified exposure to global markets. - US Stock Allocation: How Much Do VT and VWCE Invest in US Stocks?

VT allocates approximately 64% of its holdings to US stocks, reflecting the dominance of the US market in the global economy. Similarly, VWCE allocates around 57% to US stocks, showing a comparable focus on the US market.

Expense Ratio Analysis: Impact on Long-Term Returns

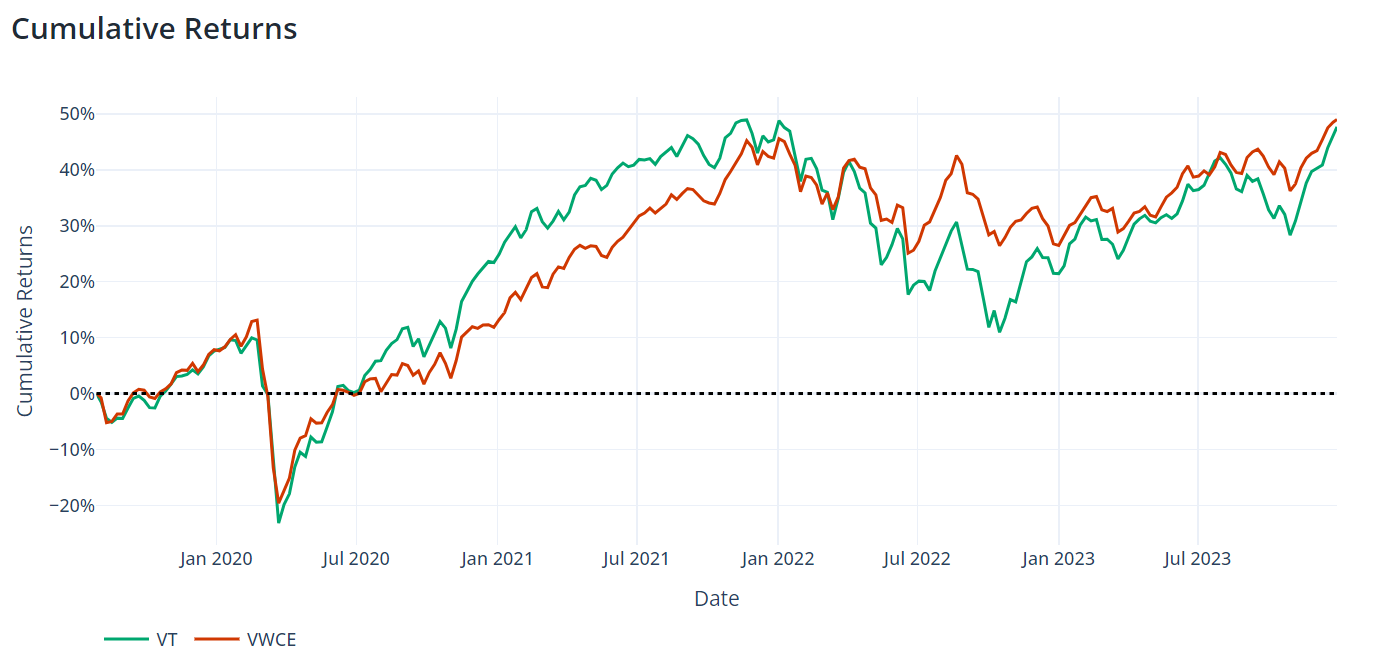

Both VT and VWCE offer global exposure, but their expense ratios can have a significant impact on long-term returns. To illustrate this, let’s refer to the ETF comparison report generated using our online tool PortfolioMetrics, which analyzes the performance of these two ETFs over the period from 01/01/2020 to 01/01/2024.

Performance Analysis: Both ETFs experienced a significant dip around early 2020, likely due to market-wide impacts, but VT recovered more robustly. The trend suggests that despite occasional fluctuations, VT's lower expense ratio may contribute to its slightly superior performance compared to VWCE over the long term.

Over longer investment horizons, the compounding effect of lower expenses can lead to significant differences in overall returns. Therefore, cost-conscious investors looking to maximize their returns from global markets may find VT a more attractive option compared to VWCE, particularly for larger investment portfolios.

To illustrate the impact of expense ratios on long-term returns, consider an initial investment of $10,000 over 30 years. With an annual return of 9.7% before expenses and an expense ratio of 0.08%, VT grows to approximately $157,287.40. In contrast, VWCE, with an annual return of 9.4% before expenses and an expense ratio of 0.22%, grows to approximately $139,409.61. This example highlights that even a small difference in expense ratios can significantly affect long-term investment outcomes, making VT a more attractive option for cost-conscious investors aiming to maximize their returns.

When to Use VT or VWCE: Scenarios and Preferences

The choice between VT and VWCE ultimately depends on an investor's preferences and investment goals but also on the investors location. Here are some scenarios where one ETF may be more suitable than the other:

U.S. Investors: For investors based in the United States, VT may be the preferred option due to its lower expense ratio and ease of access through U.S. brokerages.

European Investors: For European investors buying VT might not be possible as it is not easy to buy non-UCITS ETFs in Europe. They should therefore opt for VWCE.

Dividend-focused Investors: Investors who prefer quarterly dividends may lean towards VT, while those who prefer semi-annual dividends or have specific preferences about dividend treatment might choose VWCE.

Expense-sensitive Investors: Cost-conscious investors seeking to minimize expenses may prefer VT, given its lower expense ratio, which can translate to higher long-term returns.

Portfolio Construction and Asset Allocation

When building an investment portfolio, investors often aim to achieve broad diversification across different asset classes, sectors, and geographic regions. Both VT and VWCE can serve as core holdings within a well-diversified equity portfolio, providing exposure to global stock markets.

For investors following a passive investing strategy, VT or VWCE can act as a single, low-cost solution for capturing the returns of the global equity market. By investing in one of these ETFs, investors can gain instant diversification across thousands of stocks from various countries and industries.

Alternatively, investors may choose to combine VT or VWCE with other investments to construct a more customized portfolio. For example, an investor could allocate a portion of their portfolio to one of these global ETFs while complementing it with region-specific or sector-specific funds to tailor their exposure further.

Conclusion: Making the Right Choice Between VT and VWCE

In conclusion, both VT and VWCE offer broad exposure to global equities, but they differ in expense ratios, index composition, geographic availability, and dividend treatment. Investors should carefully evaluate their investment goals, regional considerations, and cost preferences before deciding which ETF better suits their needs.

By understanding these key differences, investors can make informed decisions to optimize their global investment strategy and achieve their financial objectives. Visit our PortfolioMetrics dashboard to analyze the performance and risks of your investment portfolio.