A well-diversified investment portfolio is essential for financial success in the ever-volatile market. Portfolio construction involves selecting a variety of assets, each with different characteristics and performance patterns. Backtesting a portfolio is a method for assessing the feasibility and performance of an investment strategy by applying it to historical data. This article delves into the nature of portfolios, the value of backtesting, and our tool called PortfolioMetrics that simplifies the process.

What does an investment portfolio consist of?

A portfolio is a collection of financial investments like stocks, bonds, funds (including mutual funds and exchange-traded funds - ETFs), commodities, and other assets held by an investor. The goal is to maximize returns while minimizing risk through diversification.

Stocks represent ownership in a company. Their value can fluctuate based on the company's performance, market conditions, and economic factors.

Bonds are fixed-income investments that represent a loan to a government or corporate entity, which pays interest over a specified period.

Funds, such as mutual funds and ETFs, are investment vehicles pooling money from multiple investors to purchase a diversified collection of stocks, bonds, or other assets.

Commodities include physical goods like gold, oil, or agricultural products, which can act as a hedge against inflation or market volatility.

What value can portfolio backtesting have for an investment decision?

Backtesting is the process of testing an investment strategy using historical data to determine how well the strategy would have worked in the past. It is critical because:

- It enables investors to assess the effectiveness of a portfolio before risking real capital.

- Investors can understand how their portfolio would have reacted during different market conditions.

- It helps in identifying and rectifying weaknesses in an investment strategy.

- It aids in understanding the portfolio's potential for risk and return.

What role does benchmarking play in portfolio backtesting?

In backtesting, the comparison with a benchmark is essential, as the assessment takes place through the comparison. A benchmark is a standard against which the performance of a portfolio can be measured. It could be a market index like S&P 500 Index, representing a broad cross-section of large-cap U.S. stocks, a Total World Stock Index, a bond index, or any other standard that represents the performance of a segment of the market.

A good benchmark should:

- Mirror the investment style and market segment of the portfolio.

- Be transparent and easily calculated.

- Have a consistent history for proper backtesting.

For example, if the investor's portfolio consists of small-cap U.S. stocks the benchmark should be S&P SmallCap 600 Index instead of S&P 500 Index. Similarly, if the portfolio consists of U.S. stocks and one German stock, using a Total World Stock Index may be more representative benchmark than S&P 500 Index.

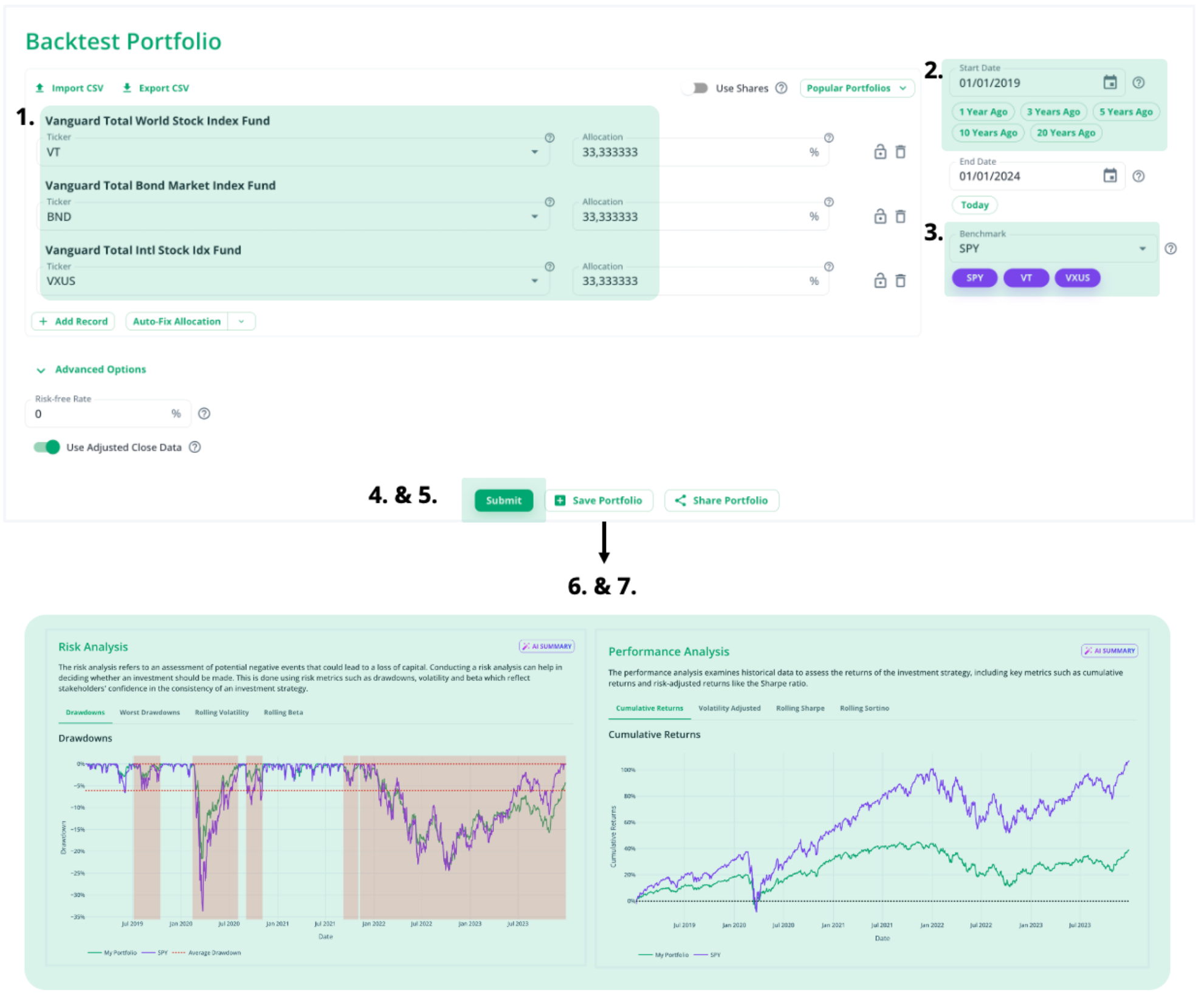

What steps do I take to backtest my strategy?

The general process involved in carrying out backtests is listed below:

- Define the portfolio: Outline the assets included and their allocation.

- Select a time frame: Choose a historical period that includes various market cycles.

- Choose a benchmark: Determine a relevant benchmark for comparison.

- Accumulate historical Data: Collect the required historical price and dividend data.

- Simulate the Strategy: Apply your investment strategy to the historical data.

- Evaluate performance: Analyze metrics like returns, volatility-adjusted returns, and compare those to the benchmark.

- Analyze risk: Assess the portfolio's volatility, maximum drawdown, and other risk metrics.

- Adjust the strategy: Modify the portfolio based on the backtesting results to mitigate risks or improve returns.

PortfolioMetrics allows investors to automate steps 4 to 8 of this process. It enables detailed analysis of performance (e.g. return and compound annual growth rate - CAGR) and risk (volatility and drawdowns). It also offers advanced calculations such as Monte Carlo simulation for forward-looking risk assessment and the Markowitz model for portfolio optimization. All results are presented in a comprehensive dashboard with charts and tables that provide a visual representation of performance. The AI-generated summaries help provide a better understanding. These reports can be saved by investors for future reference or shared with stakeholders.

Conclusion

Backtesting can be an important part of building and refining an investment portfolio. It provides data-based insights into how a portfolio would have performed under historical market conditions, allowing strategies to be adjusted. Benchmarking during the backtesting process is important to effectively measure the relative performance of the portfolio. With tools such as PortfolioMetrics, investors gain access to a sophisticated yet user-friendly platform to test and improve their investment strategy. As effective portfolio management continues to evolve, the use of such tools is becoming increasingly important for the savvy investor.