PortfolioMetrics provides a backtesting tool that offers qualitative analysis of investment portfolios. It loads price data of assets in a given portfolio and computes various metrics and charts. In addition to the backtesting tool, we are introducing new calculators: CAGR calculator and Compound Interest Calculator that will enhance your investing journey.

CAGR Calculator

Our CAGR calculator helps you easily determine the average annual growth rate of your investments over time. CAGR is a crucial metric for investors, providing a "smoothed out" growth rate that assumes steady annual compound growth. It's particularly useful for comparing investments with different time horizons or volatile year-to-year performance.

To use the calculator, simply enter your initial investment value, final investment value, and the time period in years. The calculator uses the formula:

where is the number of years.

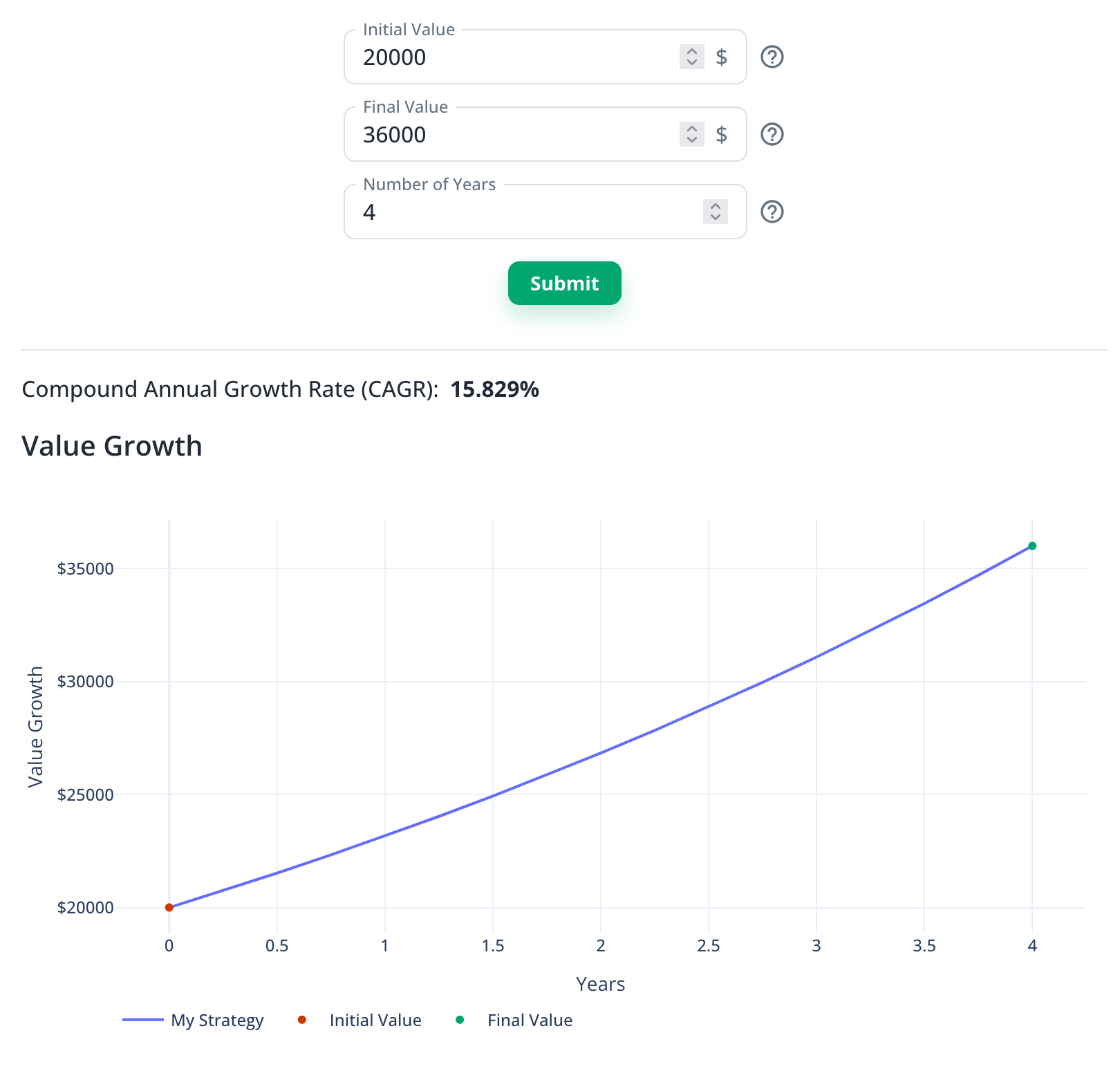

The screenshot below shows an example of CAGR calculation. With an initial investment of $20,000 growing to $36,000 over a 4-year period, the resulting CAGR is 15.829%.

When tracking investments from different investment brokers or banks over a longer period of time, it can be challenging to assess overall performance. The CAGR Calculator simplifies this process. Use your total invested value (all contributions minus withdrawals) as the "Initial Value" and the total current value of all your investments as the "Final Value" to compute CAGR. This approach provides a clear picture of your portfolio's performance across multiple accounts and investment vehicles.

This tool simplifies complex calculations, enabling you to make informed investment decisions quickly and gain valuable insights into your investment performance and potential future growth.

Compound Interest Calculator

Our comprehensive Compound Interest Calculator helps you forecast the growth of your investments or savings over time. Whether you're planning for retirement, saving for a major purchase, or simply want to see how your money can grow, this tool provides valuable insights into the power of compound interest.

The calculator takes into account your initial investment, time horizon, annual growth rate, and it factors in various cash flow scenarios:

- no additional flows,

- fixed contributions,

- fixed withdrawals,

- percentage-based withdrawals.

You can set the frequency of contributions or withdrawals to monthly, quarterly, or yearly, allowing for a more accurate representation of your financial strategy.

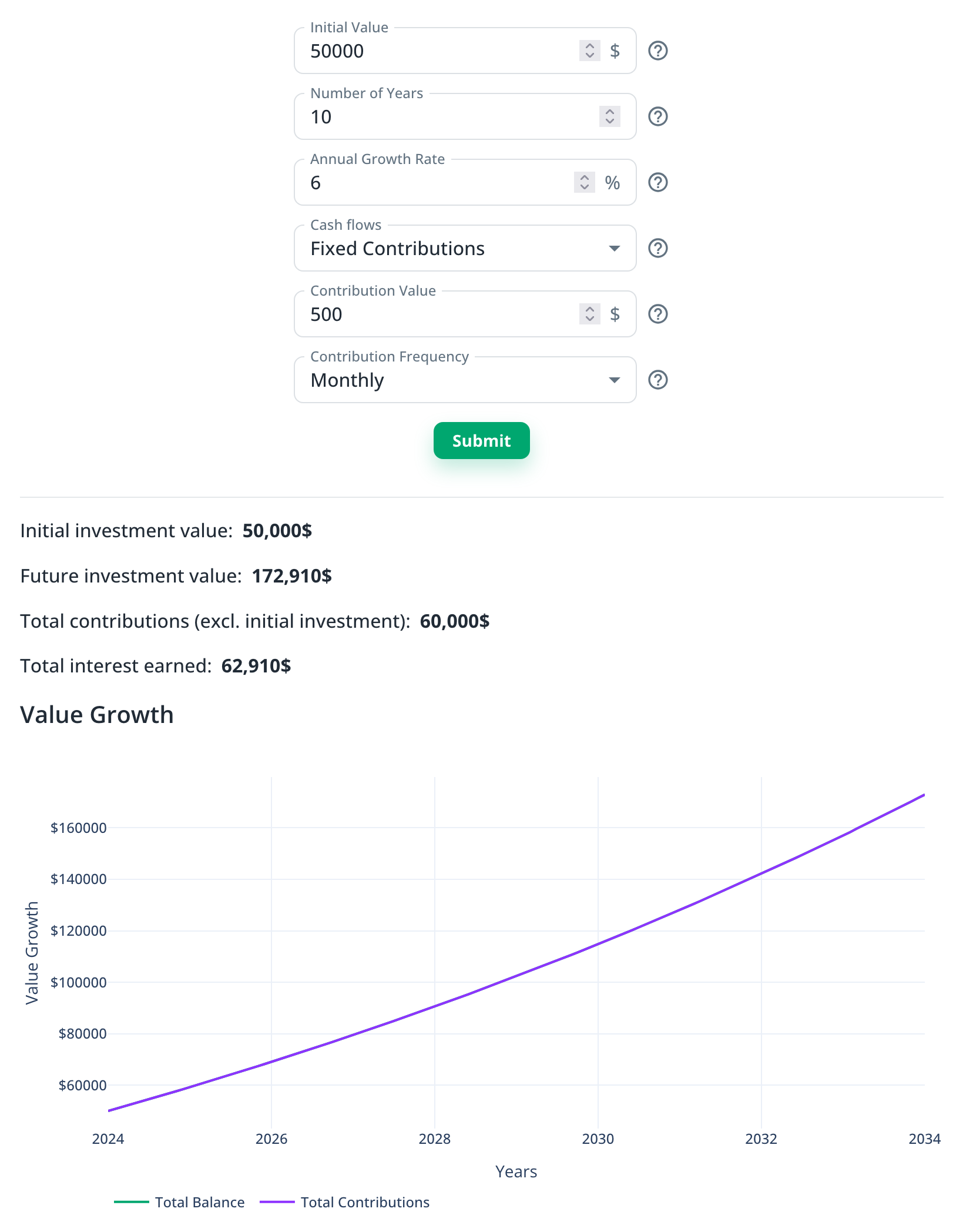

The example below illustrates the potential growth of an investment starting with an initial value of $50,000 and monthly contributions of $500. Assuming an annual growth rate of 6%, the investment could grow to approximately $172,910 over a 6-year period. This calculation is a simulation based on the specified annual growth rate. Actual investment performance may vary due to market conditions and other factors.

The Compound Interest Calculator is similar to our backtesting tool which also allows to simulate Cash Flow Options, except the calculator is based on the annual growth rate while the backtesting tool bases its computation on asset price data. Also, the Cash Flow Options in the backtesting tool are used in Portfolio Value Growth Analysis for the historical data and Monte Carlo Simulation for the future projection.

When selecting an annual growth rate, consider the following:

- For conservative estimates, use historical average returns of low-risk investments like bonds (2-5%)

- For moderate growth, consider average stock market returns over long periods (7-10%)

- For aggressive growth, you might use higher rates (10-12%), but be aware of increased risk

- Always account for inflation, which typically ranges from 2-3% annually

Remember, past performance doesn't guarantee future results. It's often wise to calculate scenarios with different growth rates to see a range of possible outcomes.

Conclusion

The CAGR Calculator and Compound Interest Calculator are useful additions to PortfolioMetrics' suite of investment tools. These calculators complement our backtesting tool, providing you with a comprehensive set of resources to analyze your investments from multiple angles.

We are committed to continuously enhancing PortfolioMetrics and providing you with cutting-edge tools for managing and analyzing your investment portfolios. Keep an eye out for more exciting updates and features in the future as we strive to meet your evolving investment needs.