History has shown that it is practically impossible to predict future stock market returns as no one knows what the future holds for economic growth, and no one can predict how investors will choose to invest. But if there's one thing we can expect about the market, it's risk. Markets will continue to fluctuate and lead to drawdowns. In other words: We will almost certainly see drawdowns on a regular basis. A stock's volatility is usually measured by its standard deviation, but many investors worry about drawdowns instead. This is especially true for retirees withdrawing money from their pension and retirement accounts. Volatile markets and high drawdowns can be problematic for retirees. Many look at the drawdown of their investments, from stocks to mutual funds, and consider the maximum drawdown so they can potentially avoid these investments.

What is a drawdown?

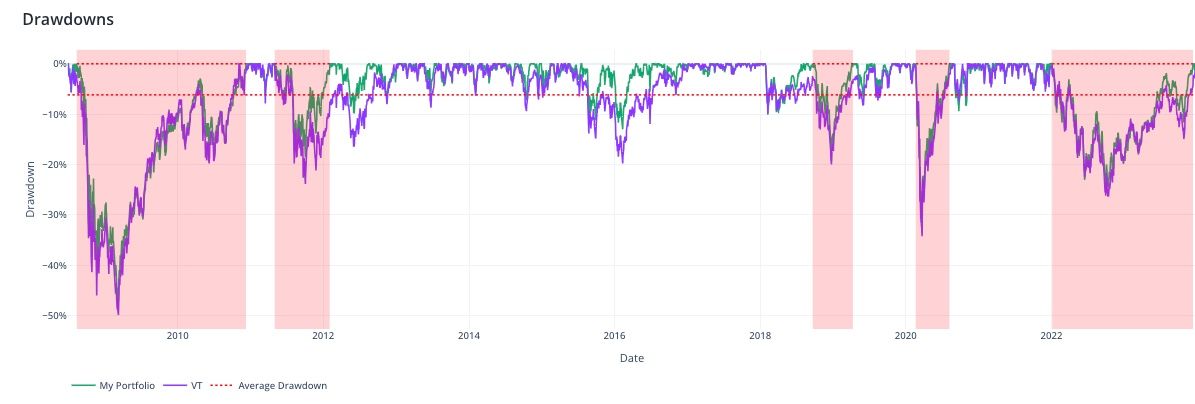

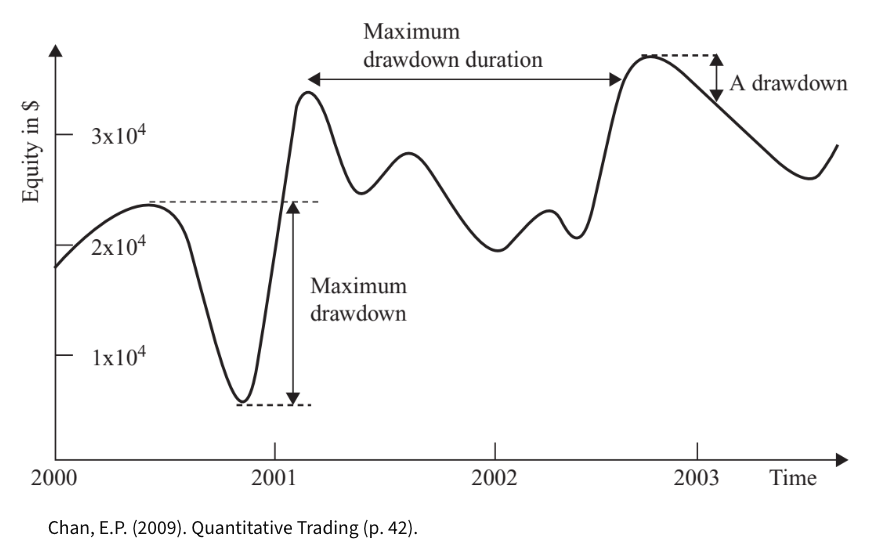

There are three terms used when analyzing drawdowns that we must first understand before we can explain their application: 1) A drawdown, which occurs whenever a strategy has recently lost money. It is usually expressed as a percentage, but can also be expressed in currencies if required. A drawdown at a given point in time is defined as the difference between the current value of the portfolio and the maximum of the equity curve at or before that point in time. Then there is 2) the maximum drawdown, which is the difference between the global maximum of the curve and the minimum of the curve after the maximum has occurred. And finally 3) the maximum duration of the drawdown, which is the longest time the equity curve needs to recover losses. Below you will find a graph illustrating these terms.

Consider this: You invest a substantial amount of money, $100,000, in a portfolio of tech stocks: Alphabet, Amazon, Apple, Meta, and Microsoft. Tech stocks are known to be particularly volatile, and this will be reflected in your portfolio as well. Let’s say that the volatility sees your account dip to $90,000, but a previous uptrend pushed your account to peak at $120,000. Now, the drawdown is calculated from the peak that your account reached ($120,000) and not from your initial capital ( $100,000). So, in this case, the drawdown experienced is $30,000 ($120,000 – $90,000).

It is important to understand that a drawdown is not a loss. A drawdown is simply the movement from a high to a low, whereas traders consider a loss to be capital in proportion to the amount originally deposited.

Why are Drawdowns Important?

Measuring drawdowns is important because they are simply unavoidable. There will always be financial crises. You may have chosen the best investment strategy, but even that strategy will have to go through these crises when the entire stock market is down. Charlie Munger once said the following: “If you can’t stomach 50% declines in your investment, you will get the mediocre returns you deserve.”

Berkshire Hathaway is a good example, the company's value has fallen by more than 50% three times: Once during the inflationary period in the 1970s, once from 1998 to early 2000, and the last time in 2008. Berkshire has also underperformed the S&P 500 for at least six years from 2015 to 2021, yet Buffett and Charlie Munger have generated an annualized return of nearly 20%. This shows how important it is to build drawdowns into the strategy from the start.

How do I incorporate drawdowns into my investment strategy?

Two criteria are particularly important when analyzing drawdowns: the percentage of reduction and the recovery time (drawdown duration). This can be illustrated well using the case of retirees who have to withdraw money from pension and retirement accounts. Not only is this group of people dependent on the money, but they also no longer have time on their side as a friend – so they are particularly risk averse.

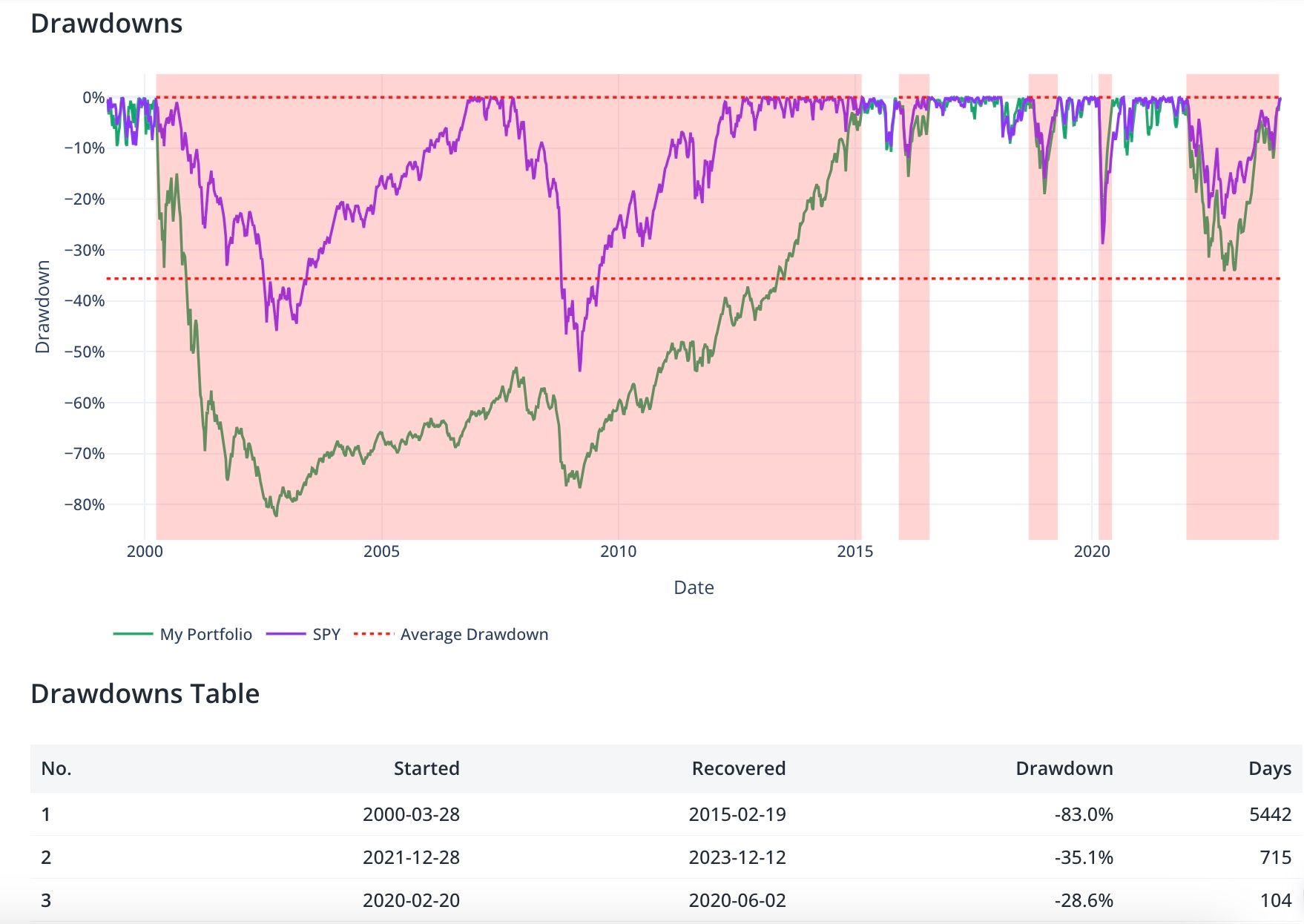

Consider the following case: Between 2000 and 2015, the NASDAQ-100 Index fell by 83%. If you had invested $100,000 at the peak, you would only have had $17,000 left two years later. A return of 590 % was required to reach the old peak again. It consequently took the Nasdaq a full 15 years ( 5442 days) to recover by 2015. From a mathematical perspective, it is important to remember that a drawdown of 50% requires a return of 100% to break even again. With a drawdown of 75%, you need to increase your remaining capital by 400%.

These figures explain quite well why it is important to take drawdowns into account and include them in the investment strategy. For retirees, choosing a strategy that has historically suffered only small drawdowns is crucial. For example, according to Investopedia, some investors choose to avoid drawdowns of more than 20% before limiting their losses and converting the position to cash.

Conclusion

For every investor, it should be important to determine the level of risk tolerance on which they are prepared to invest their money. Many investors invest too optimistically, and they lose money because they are unprepared. For this purpose, an investor should look at the historical drawdowns. How deep was the decline? How long did it take to return to the previous level? This should be matched with one's personal life situation, do I have financial obligations in the coming years, etc.? All these questions should be answered. The risk of drawdown is usually mitigated by a well-diversified portfolio. In fact, this is one of the reasons why investment funds diversify extensively. They sacrifice the potentially higher profitability for the stability of the portfolio. We’ve created a list of popular portfolio strategies or a list of ETFs that can help you make the right choice.